Chartered Accountant in Bangalore

Chartered Accountant in Bangalore – Chartered Accounting services are an essential part of any business because finance also ensures the sustainability of the organization as well as its rapid expansion. Financial reporting, in its most basic form, refers to a process which should be followed by either an organisation for capturing and sustaining financial documents associated with the business.

99.9 % Customer’s satisfaction guaranteed. No Hidden charges

Chartered Accountant in Bangalore

- Accounting Overview

- Accounting Services

Accounting Overview

This procedure entails the following steps:

- Documenting

- Outlining

- Evaluating

Only those transactions and financial accounting factors affiliated to the firm are reported.

As such, if the firm is small and activities are restricted within the same, we could admit that accounting is one vital part which will be handled through an accountant. However, with the case of a major organisation with such a significant number of financial accounts, a solitary department with many staff members would be appointed and positioned to handle this kind of accounting and financial operations.

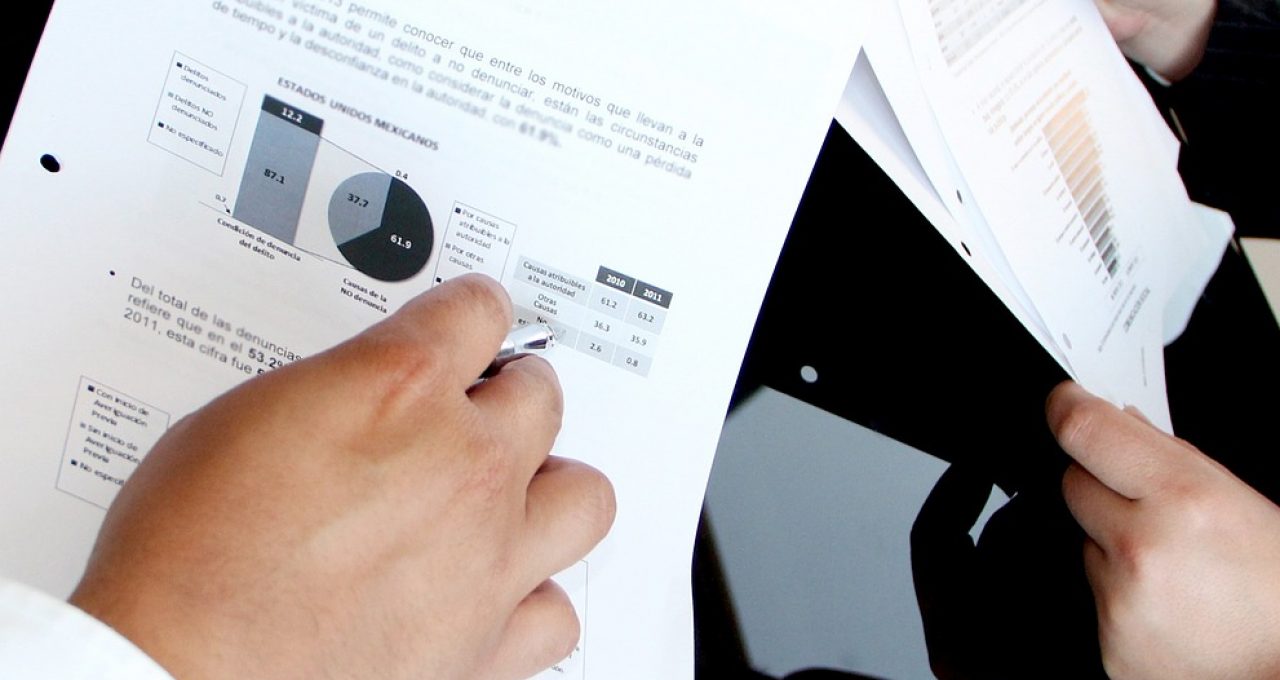

The accounting department’s report provides relevant information on the financial condition of the business which could be used in a variety of situations, both internally and externally to a organisation.

- Restricts and observes the trading business in a particular area or region.

- To make sure there is no damage towards the overall public’s health as a result of inappropriate business tactics.

- It guarantees that business units abide by the rules, regulatory requirements, and norms established.

- It governs the operations in the market by placing restrictions on certain commercialization.

- Monitoring the enterprise obligations in correlation with trading market.

Accounting Services

Provided by Ram & Co

We make your Accounting Needs Simple

One of most important aspects of a company’s organisational structure is the accounting division. A small company, a large organisation, a startup or even an established enterprise everyone require an accounting and finance dept to funnel a account system and support inside the steady growth as well as expansion of the company. Accounting services can be categorized into to the following categories:

Financial Accounting

This service is primarily concerned with summarising, conducting analysis, preparation of financial statements, and reporting transactions relevant to the entity’s financial element.

Management Accounting

This type of accountancy supports financial and non-financial judgment call by conveying facts to a company and its employees or associated workers whom were engaged in the entity’s as well as firm’s essential decision-making.

Auditing

A tax audit procedure is really essential for a company, primarily because it analyzes the following:

- Books

- Accounts

- Statutory Records

- Papers and Vouchers

Tax Accounting

Cost Accounting

Payroll

- Managing Payroll

- Calculating Taxations and other withholdings.

- Delivering Paychecks.

Ram and Co`s experts may assist you with payroll tax filing, calculating and recording deductions, and other employee benefits without difficulties or errors.

Statutory Compliances

In employment terms, legislative compliance is critical to the organization’s future success. Our accountancy expert is well-versed in tax exemptions, ESI Funds, PF Deductions, min wage standards compliance, Gratuity, Professional Taxes, and other labor-related assistance that a firm can follow or adhere according to the law in effect inside the country.

Virtual Accounting Services

As your business grows, the reach and value of your firm are likely to increase as well. Virtual accounting is one such auditing service which will assist firms in much more successfully managing one‘s financial solutions or the entire accounting with aid of accounting professionals who will work remotely, allowing it comfortable for both you and the system. Virtual accounting is cost-effective, adaptable, and efficient.

Professional Accounting Services

A crew of qualified Chartered Accountants and Compliance Officers who are not only members of organisation but have knowledge and experience to implement, curate, and deliver the accounting services effectively. At Ram and Co, we have a well-qualified and competent expert board that not only has expertise with audit procedures, accounting records management, and cash statements, as well as the capacity to deliver customer in a customised manner.

Tax Planning and Consulting

The main objective of tax planning would be to boost a company’s tax efficiency. With progressive taxation planning, all economic transactions will operate in its most tax-effective manner possible, resulting in a system that is not only efficient but also cost-effective.

Other Consulting Services

Nothing less than the best is acceptable when it comes to accounting and consulting services. Our team will assist you understand better and comprehend your financial information so that you can make more informed business decisions that help you improve and build your company. We’ll help you evaluate your company’s financial situation, as well as develop a plan or blueprint for the next phase of progress.

Every entrepreneur who desires to concentrate over how to grow their business needs with every operational situation under control. The financial element is among the most essential of these operational factors. With all the day-to-day activities and funds, it can be difficult to keep track of all other growth processes, so outsourcing your financial solutions to the Ram and Co Chartered Accountant team which is among the best options you can make.

This will secure and assist the organisation in turning its operation into a profitable one. With its corporate solution section, Ram and Co offers the most dependable, cost-effective, and high-quality audit services in Bangalore and across India. With the support and guidance of a big crew, we were able to create a distinctive appearance for your business.

Chartered Accountant in Bangalore – Accountancy is the heartbeat of any firm and the platform for making all financial and non-financial choices. At Ram & Co, we also provide bookkeeping services but also guarantee that they are personalised to meet the specific consumer demands and given in an economic way without sacrificing the effectiveness of the same.Our professional tax consultants will support you for any business taxes, tax preparation, or income tax remittance issue.

Through this, we can aid you in budget analysis by diversifying or re-stating the standards, real, and variation induced by the same. Our professionals will also assist you in analysing debts to guarantee that the organisation has the best financial health, that is not only profitable but sufficient to begin the company’s growth.

Free Estimation

Request A Quote

Focus Your Time and Efforts On Running Your Business and Leave the Accounting To Us.